jersey city property tax calculator

This northern New Jersey county has effective property tax rates that are more than double the national average. Contact Your Assessors Office For Detailed Property Tax.

Tax Bill Breakdown City Of Woodbury

Property tax sometimes called an ad valorem tax is a tax on real estate and some other types of property.

. Our property records tool can return a variety of information about your property that affect your property tax. As mentioned above property taxes are usually tax deductible on your New Jersey income tax return. TAX DAY NOW MAY 17th - There are -391 days left until taxes are.

Start filing your tax return now. In many cases we can compute a more personalized property tax estimate based on your propertys actual assessment valuations. If you have questions about how property taxes can affect your overall financial plans a financial advisor in Cherry Hill can help you out.

Prior to 2018 the maximum property tax deduction was 10000. Local governments typically assess. From country estates to city apartments your ideal property is just a click away.

Baltimore City collects on average 115 of a propertys assessed fair market value as property tax. The median property tax in Baltimore City Maryland is 1850 per year for a home worth the median value of 160400. Baltimore City has one of the highest median property taxes in the United States and is ranked 543rd of the 3143 counties in order of median property taxes.

This calculator is excellent for making general property tax comparisons between different states and counties but you may want to use our California property tax records tool to get more accurate estimates for an individual property. Property for sale in Jersey Channel Islands from Savills world leading estate agents. Starting with tax year 2018 you can now deduct up to 15000 of property taxes.

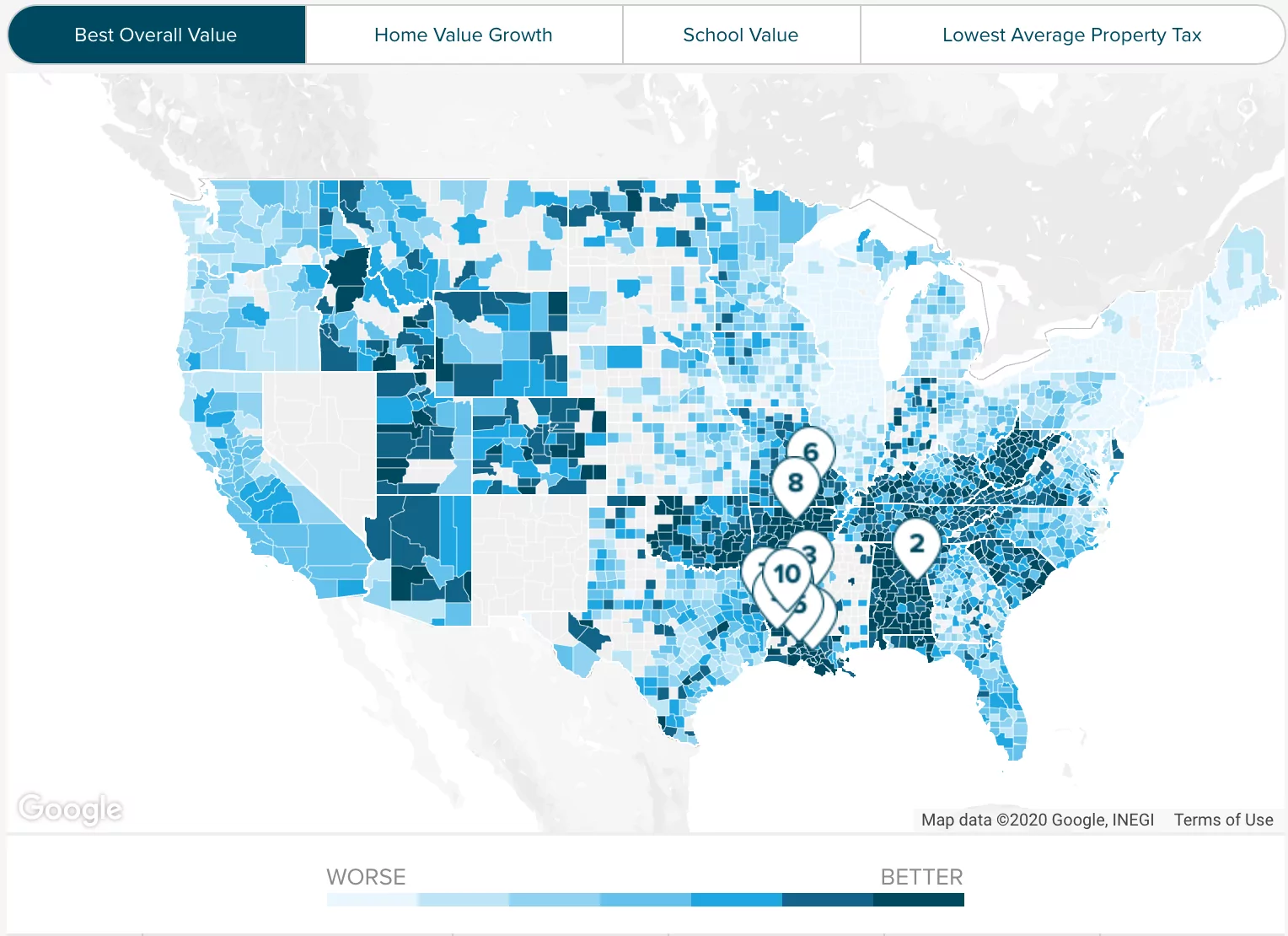

Available information includes property classification number and type of rooms year built recent sales lot size square footage and property tax valuation assessment. The countys average effective property tax rate is 346. In Bergen and Essex Counties west of New York City the average annual property tax bill is over 10000.

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Mumbai Improves Property Tax Accountability Building Society Property Tax Ncr

Riverside County Ca Property Tax Calculator Smartasset

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Compare Current Mortgage Rates In 2021 Mortgage Rates Current Mortgage Rates Mortgage

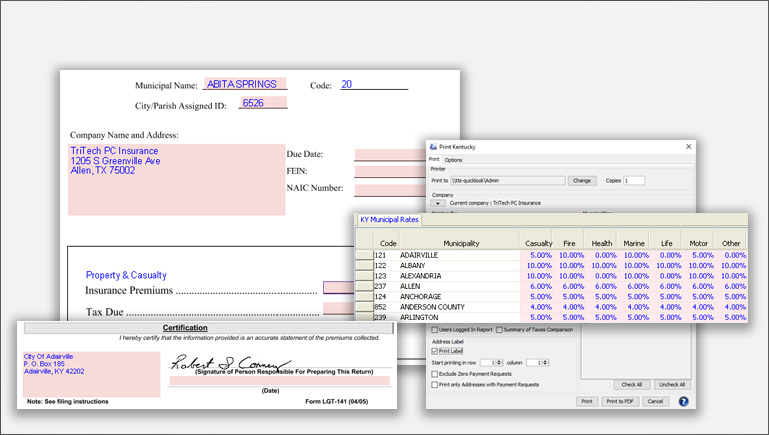

Municipal Tax Tritech Software

Property Tax How To Calculate Local Considerations

Co Op Vs Condo In Nyc A Detailed Comparison And Faq Hauseit Condo Nyc Condo Real Estate Infographic

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Infographic How Can You Use Home Equity Reverse Mortgage Home Equity Mortgage Amortization Calculator

Township Of Nutley New Jersey Property Tax Calculator

Nyc Coop Closing Costs Seller Hauseit Closing Costs Nyc Cost

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Calculate Biweekly Home Loan Payments Mortgage Payment Calculator Mortgage Payment Mortgage Calculator

7 Tax Benefits Of Owning A Home A Complete Guide For Filing This Year Home Ownership Home Buying Tips Real Estate

Nyc Real Estate Buyers Agent Duties Hauseit Real Estate Buyers Agent Real Estate Buyers Nyc Real Estate

New York Property Tax Calculator 2020 Empire Center For Public Policy